Unlocking AI Business Value with FinOps

This paper outlines how FinOps practitioners can identify the business value generated by AI investments.

The paper presents:

- The rising importance of AI in business and to meeting business objectives overall

- A model for incrementally assessing business value as AI solutions mature and develop from concept to product

- A prioritization rubric for assessing new AI solution projects

- Recommendations on how to manage AI Spending to drive value from a FinOps Phases (Inform, Optimize, Operate) perspective, and

- Challenges you may experience in quantifying the value of your AI solution projects, along with recommendations for how to address them.

These perspectives and practices are brought to you by the AI Working Group and are subject to change as the space advances.

The Rising Importance of AI in Business

Artificial Intelligence (AI) is transitioning from an experimental technology to a core business imperative. What was once a niche area of technology exploration for forward-thinking organizations is now becoming essential to maintaining competitiveness in nearly every business.

The data strongly supports this trend. McKinsey’s research indicates that 72% of organizations have adopted AI, a significant increase from approximately 50% in previous years. Notably, McKinsey identifies “Gen AI high performers” – companies that are strategically deploying AI across various business functions while carefully managing risks – and these organizations are already realizing substantial financial returns from their AI investments. Furthermore, IDC projects that global spending on AI systems will reach $632 billion by 2028, while Gartner goes further forecasting over $644 billion in GenAI spending in 2025. This level of investment signifies a shift from considering AI as a desirable option to recognizing it as a critical necessity. We’ve moved from “Wouldn’t it be nice?” to “How quickly can we implement this?”

Broader adoption represents a fundamental shift. The focus is no longer on AI’s capabilities in isolation, but on its contribution to achieving critical business objectives. The key question has evolved from “What can AI do?” to “What must we achieve, and how can AI be a part of the solution?”

For those wishing to achieve value from AI systems, this change in mindset must permeate every aspect of AI implementation, from project selection to performance measurement and operations.

Measuring the business value of AI is the cornerstone of any successful AI endeavor. AI projects, like all IT projects, must yield tangible, measurable results and directly contribute to an organization’s success.

The change in mindset that accompanies this dramatic increase in spending also means that the urge to “add AI to everything,” or to focus on a single AI use case must also evolve to become a more mature AI strategy. Selecting the AI models and services to focus on is the topic of the previous working group paper, Choosing an AI Approach, which may help organizations maturing their strategy. Work may also be required in organizations to rethink decisions made earlier in the AI technology lifecycle.

Assess AI Business Value Incrementally

Every AI initiative must answer a fundamental question: “Did we achieve the objectives set?” Success isn’t solely about technical execution; it’s about delivering measurable business value within budget, and without creating unsustainable maintenance costs.

Business value extends beyond purely financial metrics. It encompasses both tangible and intangible benefits, all directly linked to organizational objectives. By identifying and aligning AI investments with specific “business drivers,” organizations can effectively quantify their success.

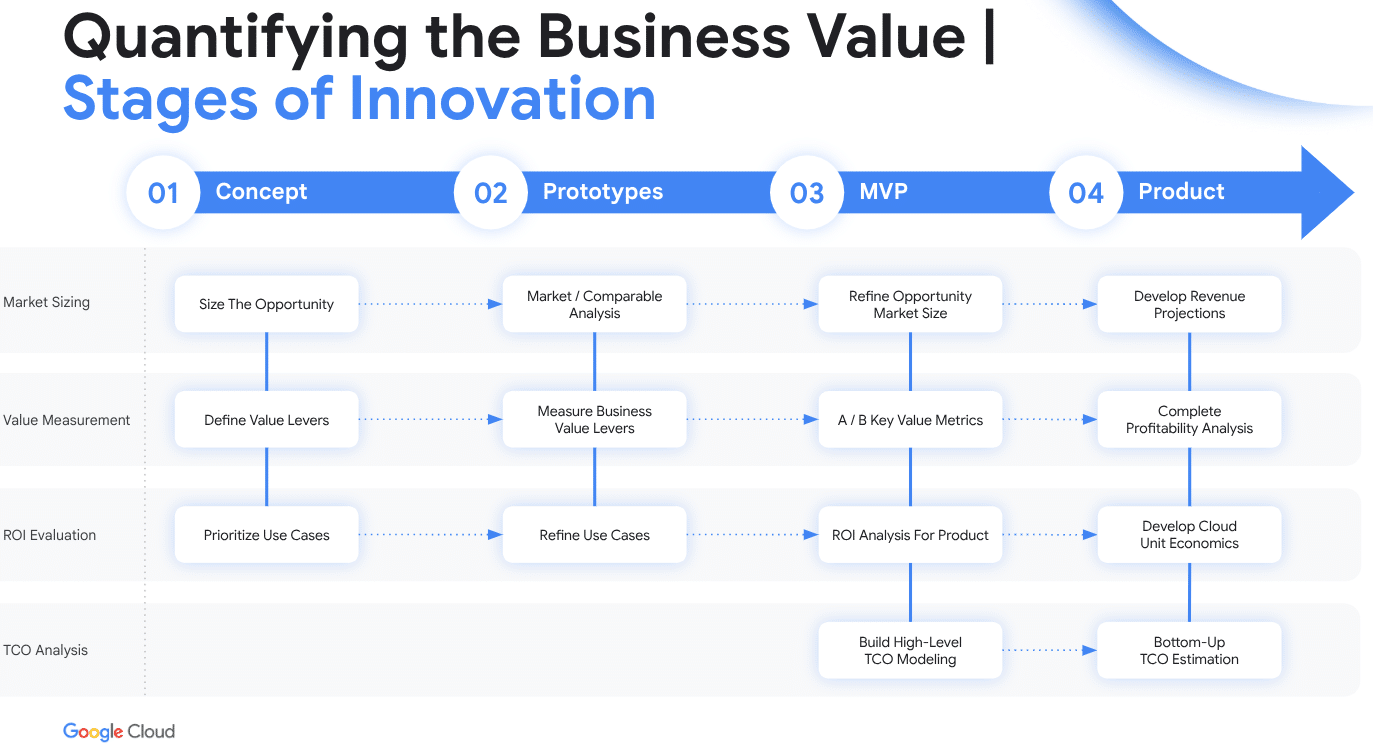

Quantifying the impact of AI requires a structured, iterative approach. The figure below (adapted from Google Cloud) illustrates four key stages of an AI Solution’s development: Concept, Prototypes, MVP (Minimum Viable Product), and Product.

Source: Google Cloud PlatformAs the AI solution proceeds from Concept to Product, the approaches to value measurement evolve. It begins with high-level estimations and progresses to more granular, data-driven analysis. It is possible (maybe likely) that concepts and prototypes may not ultimately lead to products. At each stage, we examine:

- Market Sizing: Understanding the potential market reach and demand.

- Value Measurement: Defining and quantifying the expected benefits.

- ROI Evaluation: Assessing the return on investment.

- TCO (Total Cost of Ownership) Analysis: Calculating the complete cost of the AI solution over its lifecycle.

This phased approach ensures that investments align with expected returns and that resources are focused on projects with the highest potential for success.

The FinOps team can help to manage through this innovation cycle by supporting decision making along the way, both by presenting a FinOps perspective at every level, and ensuring that other technical considerations (and their financial impacts) are being considered transparently when decisions are made.

AI’s Business Value Drivers

First, consider how an AI solution will drive tangible, measurable benefits. The most common business drivers include:

- Employee Productivity: Automating tasks and augmenting human capabilities.

- Revenue Increase: Generating new revenue streams or enhancing existing ones.

- Cost Efficiency: Reducing operational costs and improving resource utilization.

- Customer Experience: Enhancing customer satisfaction, loyalty, and retention.

- Operational Resiliency: Improving the ability to withstand and recover from disruptions.

- Competitive/Strategic Advantage: Gaining a competitive edge through innovation and market positioning.

Whether an AI Solution generates direct financial benefits, operational efficiencies, innovation & strategic alignment, customer value, employee productivity, or scalability opportunities, there are questions that the FinOps team may be in the best position to help the organization consider:

- Employee Productivity: Can AI automate tasks and enhance human capabilities?

- Example: AI-powered assistants like GitHub Copilot enable developers to write code more quickly and reduce time spent on debugging.

- FinOps Perspective: How much does this efficiency gain cost compared to baseline productivity? How are productivity measures currently measured? Are multiple services being used to accomplish the same results? FinOps tracks AI usage on a per-user, or unit metric basis to prevent excessive or duplicative cost.

- Revenue Increase: Will AI create new revenue streams or enhance existing ones?

- Example: AI-driven recommendation engines (like those used by Amazon) to increase sales.

- FinOps Perspective: Does the AI generate more revenue than it costs to operate? FinOps ensures accurate cost allocation to understand the true cost of AI relative to the revenue it generates.

- Cost Efficiency: Can AI optimize resource utilization and reduce operational costs? Are the costs of training, tuning, and supporting the AI model justified by the expected return?

- Example: AI-powered auto-scaling dynamically adjusts workloads, reducing cloud costs by eliminating idle server resources.

- FinOps Perspective: Is AI genuinely saving money, or is it simply automating existing inefficiencies? Is the underlying workload architecture optimal? FinOps may identify a variety of optimization capabilities to address underlying architectural issues or ensure that cost savings are appropriate.

- Customer Experience: Will AI enhance customer satisfaction and loyalty?

- Example: AI chatbots provide instant responses, reducing customer wait times and improving satisfaction.

- FinOps Perspective: Is the AI-powered support system worth the cost, or would a simpler solution be sufficient? Are specific customer interactions and their outcomes being evaluated? How is the value to the customer being compared, using unit economics, to the cost per interaction being charged? FinOps ensures cost-effective enhancements to the customer experience.

- Operational Resiliency:

- Example: AI monitoring tools predict system failures before they occur, minimizing downtime.

- FinOps Perspective: Do we need all of these monitoring tools? FinOps helps right-size monitoring investments for duplication to achieve maximum impact at minimal cost.

- Competitive/Strategic Advantage: Does the AI initiative support the company’s Objectives and Key Results (OKRs)?

- Example: AI-driven analytics help companies outmaneuver competitors by predicting market shifts.

- FinOps Perspective: Are we using AI for genuine competitive gain, or is it simply for hype? FinOps aligns AI spending with long-term strategy and compares it against industry benchmarks.

Organizations that define clear objectives, measure progress, and track long-term impact will ensure sustainable AI value delivery. Ask the right questions of those leading AI Solution projects. Sometimes the most serious mistakes are made not by having the wrong answers, but by not asking the right questions.

AI’s Technical Feasibility Drivers

In addition to considering the business and financial drivers of value, FinOps teams should be asking questions about the technical feasibility of AI solutions as well. Implications of not considering feasibility up front may lead to failure to achieve the desired business outcome, failure to proceed to the next stage of innovation, or worse yet a commitment of resources by the organization that could have been avoided or limited. This is a particular concern with AI solutions given the volatility and fast-changing nature of the AI market for services and the scarcity of some AI solution resources (human and technical) at this time. FinOps teams should ensure that the AI solution being considered has demonstrated:

- Data Availability & Quality: Is there sufficient, high-quality data available to train and deploy the AI model? Does the organization understand how it will gather, load, and maintain data over time? Has the organization considered data storage, the timeline of data acquisition, and security considerations for data use?

- Infrastructure Readiness: Can the current IT infrastructure support the AI workload? Are infrastructure components used in early MVP releases sufficient to allow scaling to envisioned scale at product launch?

- Talent & Skills: Does the organization possess the necessary expertise to develop, deploy, and maintain the AI solution?

- Integration Complexity: How will AI solutions be integrated into existing systems and applications? Are current product and application owners aware, prepared, and supportive of this integration?

Prioritize AI Use Cases

To effectively leverage AI, organizations can use a structured approach to prioritizing potential use cases by evaluating each project based on Business Value and Technical Feasibility.

| Low Feasibility | High Feasibility | |

| High Business Value | Evaluate for Future Investment | High-Priority Projects |

| Low Business Value | Low-Priority Initiatives | Tactical/Exploratory Projects |

Prioritize work by quadrant based on what you are able to and wish to achieve.

- High Business Value, High Feasibility (High-Priority Projects): These are “quick wins” and should form the core of your AI solutions. They offer strong, clearly articulated business impact and are relatively straightforward/feasible to implement. Prioritize these for immediate investment.

- High Business Value, Low Feasibility (Evaluate for Future Investment): These projects are strategically important but challenging to implement. Focus on overcoming feasibility barriers by improving data quality, infrastructure, or skills. Keep track of these opportunities if the business value is large, because fast paced changes in AI technology may make them more feasible before much time passes.

- Low Business Value, High Feasibility (Tactical/Exploratory Projects): These projects are feasible but offer limited strategic value. They can be useful for testing AI capabilities or building internal skills. These may make up the bulk of your AI work when very early in the adoption cycle.

- Low Business Value, Low Feasibility (Low-Priority Initiatives): These projects are difficult to implement and offer minimal business impact. They are generally not worth the effort and should be reconsidered or deprioritized. There may be instances of broad experimentation with AI where early efforts need to be readdressed.

Manage AI Spending with FinOps

The continuous loop of Inform, Optimize, Operate phases of the FinOps practice provides a practical way to manage and optimize the costs associated with the AI use cases prioritized using the rubric above. A regular and frequent review of AI solutions being developed, and a specialized AI scope for your FinOps practice can allow you to pay specific attention to AI investments while they are growing and evolving so quickly.

Inform:

- Mapping Costs to Use Cases: In the Inform phase, it’s crucial to track and allocate costs specifically to each prioritized use case. This goes beyond simply tracking overall cloud spend; it requires granular visibility into the resources consumed by each AI project (e.g., compute for training, storage for data, inference costs).

- Forecasting by Priority: Forecasting should be done on a per-use-case basis, taking into account the priority level. High-priority projects might have more aggressive growth projections, while low-priority projects might have minimal or no projected spend.

- Communicating Value and Cost: Communicate not only the cost of each use case but also its potential business value (as determined in the prioritization rubric) to stakeholders. This helps justify the investment and manage expectations.

Optimize:

- Prioritized Optimization Efforts: Focus optimization efforts on the high-priority use cases first. These projects offer the greatest potential return on optimization investment.

- Tailoring Optimization Strategies: The specific optimization techniques used will vary depending on the use case. For example, a high-priority, high-feasibility project might warrant significant investment in model optimization (e.g., pruning, quantization) to reduce inference costs. A low-priority project might only justify basic resource right-sizing.

- Re-evaluating Low-Feasibility Projects: For high-value, low-feasibility projects, the Optimize phase might involve investing in infrastructure upgrades or data cleansing initiatives to improve feasibility.

Operate:

- Continuous Monitoring by Use Case: Continuously monitor the costs and performance of each use case, paying particular attention to any deviations from the forecast.

- Performance Analysis Linked to Business Value: Analyze the performance of each AI project not just in terms of technical metrics (e.g., accuracy) but also in terms of its contribution to the defined business drivers (e.g., revenue increase, cost reduction).

- Dynamic Resource Allocation: Use the ongoing monitoring and analysis to dynamically allocate resources across use cases. If a high-priority project is exceeding expectations, it might warrant additional resources. If a low-priority project is underperforming, resources might be reallocated.

- Governance and Policy: Establish policies for managing AI spend, ensure accountability, setting spending limits or approval workflows for high-priority projects.

By integrating the prioritization rubric with the FinOps cycle, organizations can ensure that their AI investments are both strategically aligned and cost-effective.

Challenges in Quantifying AI Value

Measuring AI’s value is inherently complex because AI doesn’t fit neatly into traditional cost-benefit models. Unlike standard IT investments, AI’s benefits often extend beyond direct cost savings to include:

- Efficiency Gains: Streamlining processes and reducing manual effort.

- Automation: Automating repetitive tasks, freeing up human workers for higher-value activities.

- Predictive Intelligence: Anticipating future trends and making proactive decisions.

- Risk Reduction: Identifying and mitigating potential risks, such as fraud or security breaches.

Many of these benefits are intangible or manifest over the long term. Furthermore, AI’s rapid evolution, its integration with broader systems, and its dependence on data quality and regulatory compliance add further layers of complexity.

1. AI’s Rapid Evolution and Model Lifecycle Challenges

AI models are constantly evolving. New architectures, improved accuracy, and cost-optimized alternatives emerge frequently. This presents challenges:

- Rapid Obsolescence: An organization might invest in a state-of-the-art model, only to see a more efficient and cost-effective alternative appear shortly thereafter.

- Ongoing Tuning: AI models often require continuous fine-tuning as user behavior or data patterns change. Static ROI calculations quickly become outdated.

To sustain AI’s business impact, companies must balance short-term investments with long-term adaptability, ensuring that AI initiatives align with evolving industry trends.

2. AI’s Intangible Benefits and Broader Business Impact

Many AI benefits are not directly measurable in financial terms, yet they significantly impact:

- Customer Experience: AI-driven personalization can enhance customer satisfaction and loyalty, but quantifying the long-term impact of increased retention on ROI is challenging.

- Brand Perception: AI-powered fraud detection protects a brand’s reputation, but this doesn’t directly generate revenue.

- Cross-Functional Efficiency: AI-driven supply chain optimization can improve vendor relationships and resilience, benefits that are not easily captured in financial statements.

These benefits require new measurements that incorporate non-monetary success metrics, such as:

- Net Promoter Score (NPS): Measuring customer loyalty and willingness to recommend.

- Brand Trust: Assessing customer confidence in the brand.

- Operational Resilience: Quantifying the ability to withstand and recover from disruptions.

3. Longer Time Horizons and Broader Scope of AI Initiatives

Unlike traditional software implementations with predictable ROI timelines, AI’s value often materializes over longer periods and across multiple business units:

- Predictive Maintenance: A predictive maintenance system might take years to yield measurable cost savings.

- Workflow Changes: Full adoption of AI-driven automation often requires significant workflow changes across departments.

- Cross-Functional Models: AI-powered demand forecasting can deliver efficiencies across multiple teams, but the value is often underreported if measured in silos.

Organizations need a centralized AI strategy to track these cross-functional efficiencies and ensure that benefits are not lost due to departmental fragmentation.

4. Attributing Value Solely to AI in a Broader System

AI rarely operates in isolation. It’s typically part of a larger ecosystem that includes human decision-makers, IT infrastructure, and business processes. Isolating AI’s specific contribution is difficult:

- Marketing Campaigns: A marketing AI model might increase conversions, but how much of that success is due to the AI versus improved campaign strategies or seasonal demand?

- Cybersecurity: An AI-based cybersecurity system detects threats, but its effectiveness is amplified by strong IT policies and human intervention.

- Automation: AI-driven automation reduces manual workload, but other operational changes might also contribute to efficiency gains.

Accurately attributing AI’s impact requires multi-factor analysis and avoiding oversimplified attributions that either overestimate or underestimate AI’s role.

5. Ensuring Data Privacy and Security in AI Systems

Data privacy and security are critical concerns. AI models that process sensitive data (e.g., health records, financial transactions) require compliance with regulations like GDPR, CCPA, and HIPAA. This can:

- Increase Implementation Costs: Data encryption, federated learning, and access control mechanisms add to the cost.

- Delay Adoption: Compliance reviews and security audits can slow down the deployment of AI systems.

- Limit Potential: Restrictions on accessing high-value data sources can limit AI’s full potential.

Companies must factor in these compliance costs and risk mitigation benefits when evaluating AI’s overall value.

6. Integrating AI with Legacy IT Infrastructure

Many organizations operate on legacy IT systems that were not designed for AI workloads. This creates friction and adds hidden costs:

- High Integration Costs: Connecting AI models to outdated systems (ERP, CRM, data warehouses) can be expensive.

- Latency Issues: Inefficient legacy architectures can lead to latency problems in real-time AI inference.

- Technical Debt: Patching old infrastructure instead of modernizing it for AI scalability creates technical debt.

Organizations must assess AI’s value not just in terms of model performance but also in terms of its total cost of deployment, maintenance, and integration.

7. Improving Data Quality and Availability for AI Models

AI’s effectiveness is directly tied to the quality of the data it learns from. Poor data quality leads to unreliable predictions and reduces AI’s business impact. Common challenges include:

- Incomplete or Inconsistent Data: Manual entry errors and inconsistencies in enterprise databases.

- Siloed Data: Data residing in different departments, making it difficult to build holistic AI models.

- Outdated Data Pipelines: Pipelines that fail to support real-time AI processing needs.

Companies must prioritize data engineering, governance, and accessibility improvements to maximize AI’s value.

8. Addressing AI Talent Shortages and Skill Gaps

AI requires specialized expertise, but talent shortages in AI engineering, data science, and MLOps create bottlenecks:

- High Hiring Costs: Competition for AI specialists drives up salaries.

- Skill Gaps: Existing IT teams may lack the necessary AI skills.

- Vendor Dependency: Reliance on external vendors and consultants increases costs and reduces in-house expertise.

Organizations must invest in upskilling programs, partnerships, and automated AI platforms to mitigate this challenge.

9. Ensuring Regulatory Compliance in AI Deployment

Governments and industry regulators are increasingly scrutinizing AI deployments, particularly in sensitive areas like finance, healthcare, and HR. Compliance challenges include:

- Bias Detection and Fairness Audits: Required for AI models used in hiring, lending, and legal decisions.

- Traceability Requirements: For AI-driven predictions in healthcare and finance.

- New AI Regulations: Emerging regulations like the EU AI Act and the NIST AI RMF impose stricter governance frameworks.

Failure to comply can result in penalties, reputational damage, and financial loss, impacting AI’s perceived value.

10. Optimizing Cost Efficiency in AI Implementation

AI’s computational costs, especially in deep learning, can be significant. Organizations must optimize for:

- Cloud vs. On-Premises Deployment: Balancing cost and control.

- Model Efficiency Techniques: Using techniques like quantization, pruning, and optimized inference engines.

- Auto-Scaling: Matching AI workloads to real-time demand.

Without cost-aware AI governance, businesses risk overprovisioning resources, increasing technical debt, and eroding AI’s financial viability.

Final Thoughts

AI’s value isn’t solely about direct cost savings; it encompasses efficiency, risk reduction, customer impact, and long-term business transformation. To effectively quantify AI value, companies must:

-

- Expand ROI and TCO Models: Include intangible benefits and long-term efficiencies.

- Ensure Strategic Integration: Integrate AI into a well-defined, cross-functional strategy.

- Factor in All Costs, Benefits, and Risks: Account for data quality, security, compliance, and infrastructure modernization.

- Invest in Governance: Implement AI governance, monitoring, and continuous optimization.

- Increase Speed of Decision Making: Build upon the capabilities the FinOps team has built in managing large scale decision making in public cloud to focus on AI value specifically and ensure data are transparently presented and considered across all personas

Measuring AI’s impact requires a holistic, business-wide approach, ensuring that AI is not just a technology investment but a driver of strategic and scalable value.

Acknowledgments

We’d like to thank the following people for their work on this Paper:

Eric Lam

Google

Natasha Xu

BMO

Swapna Samuel

BMO

Karl Hayberg

EY

Brent Eubanks

Wayfair

Ilia Semenov

StealthWe’d also like to thank our supports and FinOps Foundation staff for their help on this asset: Rob Martin and Andrew Nhem.