February 22, 2024 | Article: 10-minute read

Key Insight: With economic pressure increasing across the world in 2023, many organizations are leaning on their FinOps teams to help prioritize cloud optimizations. Reducing waste and managing commitment-based discounts unseated empowering engineers to take action as the top key priority for the first time. Teams are also investing in their forecasting capabilities to better predict cloud spend, and the cost of running AI/ML is expected to have a big impact on FinOps practices in 2024. Sustainability teams have limited intersection with FinOps teams today, but that number is expected to increase substantially in the future.

Watch the replay of the February 2024 FinOps Foundation Summit to hear the details.

The State of FinOps is an annual survey conducted by the FinOps Foundation since 2020 to collect information about key priorities, industry trends, and the direction of the FinOps practice. The survey informs a range of Foundation activities and tells the broader market how FinOps is practiced in a variety of organizations. All FinOps practitioners are encouraged to respond to the survey thoroughly and honestly so the data will reveal insights that are valuable to the community.

The State of FinOps survey is conducted with a continuous collection model, meaning it is open year round. Each year in January, a snapshot of the data is taken, and analyses are shared. The questions included in the survey are carefully curated each year based on input from the community. This year we crafted questions to better understand where the FinOps practice is today, how it has changed, and what to expect in the near future.

The 2024 survey included 38 questions that yielded a variety of insights. Data were collected from 1,245 respondents with an average annual cloud spend per company of $44M, with some companies reporting up to $1B+ in annual cloud spend. No paid services are used or incentives offered to take the survey.

Figure 1: Survey respondents spend a total of $55B in the cloud, representing a significant proportion of total cloud spend worldwide.

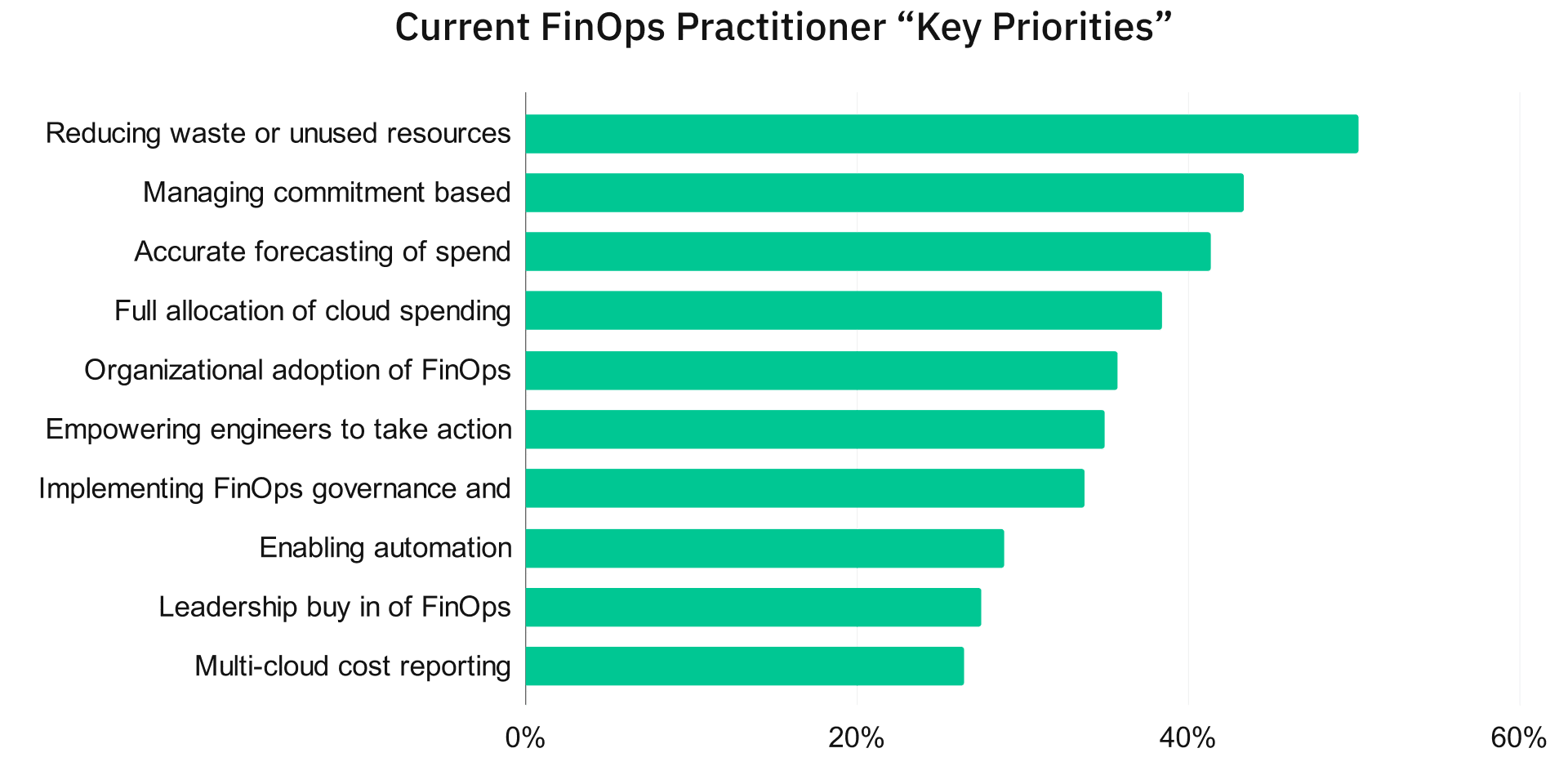

For the first time, Reducing waste was the highest key priority for FinOps practitioners across all spending tiers. This may be influenced by macroeconomic trends, with businesses looking for ways to reduce spending without reducing the value they are getting from their cloud investments.

Empowering engineers to take action has fallen from the top spot for the first time since the survey began in 2020, signaling the importance currently placed on reducing waste. We believe FinOps practitioners still view empowering engineers as an important pathway to achieving cost efficiency, and it remains high on the list of key priorities.

When the data are split by cloud spend, we see that reducing waste or unused resources remains at the top across spending tiers, but differences emerge in the second highest priorities. For lower spenders, the second priority is accurate forecasting of spend. This reflects the need to understand the trajectory of spending before it gets out of hand.

For the highest spenders, accurate forecasting fell to the fifth position, likely reflecting their more mature forecasting capabilities. With forecasting established, full allocation of cloud spending rose to third spot for those spending $100M or more per year.

⇒ The challenges of full allocation for high spenders is evidenced by the sample of companies contributing to the FOCUS open billing data specification (e.g., Walmart, CapitalOne, Meta, Disney, Box, BMW, Teck, Equinor, etc).

High cloud spenders see managing commitment-based discounts (Reserved Instances, Savings Plans, Committed Use Discounts, and negotiated discounts) as their second highest priority, reflecting the complexity of managing numerous discount plans, and their potential for high savings.

Figure 3: Key priorities for FinOps practices shown by cloud spend. Optimization remains a high priority across spending tiers.

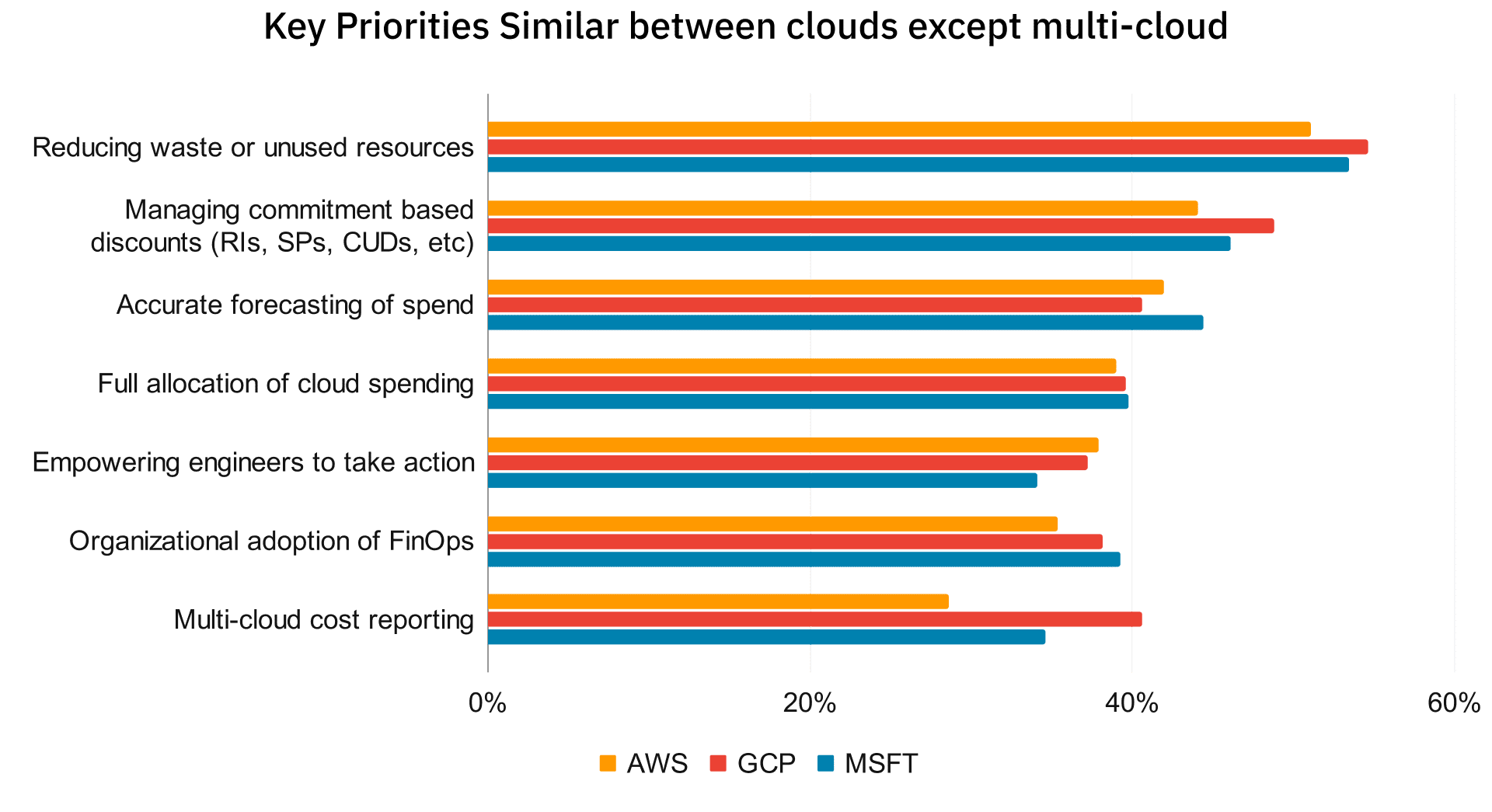

When we split the data by the primary cloud provider used, the priorities remain fairly consistent between clouds, with one exception: Multi-cloud cost reporting is of higher importance for Google Cloud users than it is for those whose primary cloud is AWS or Microsoft.

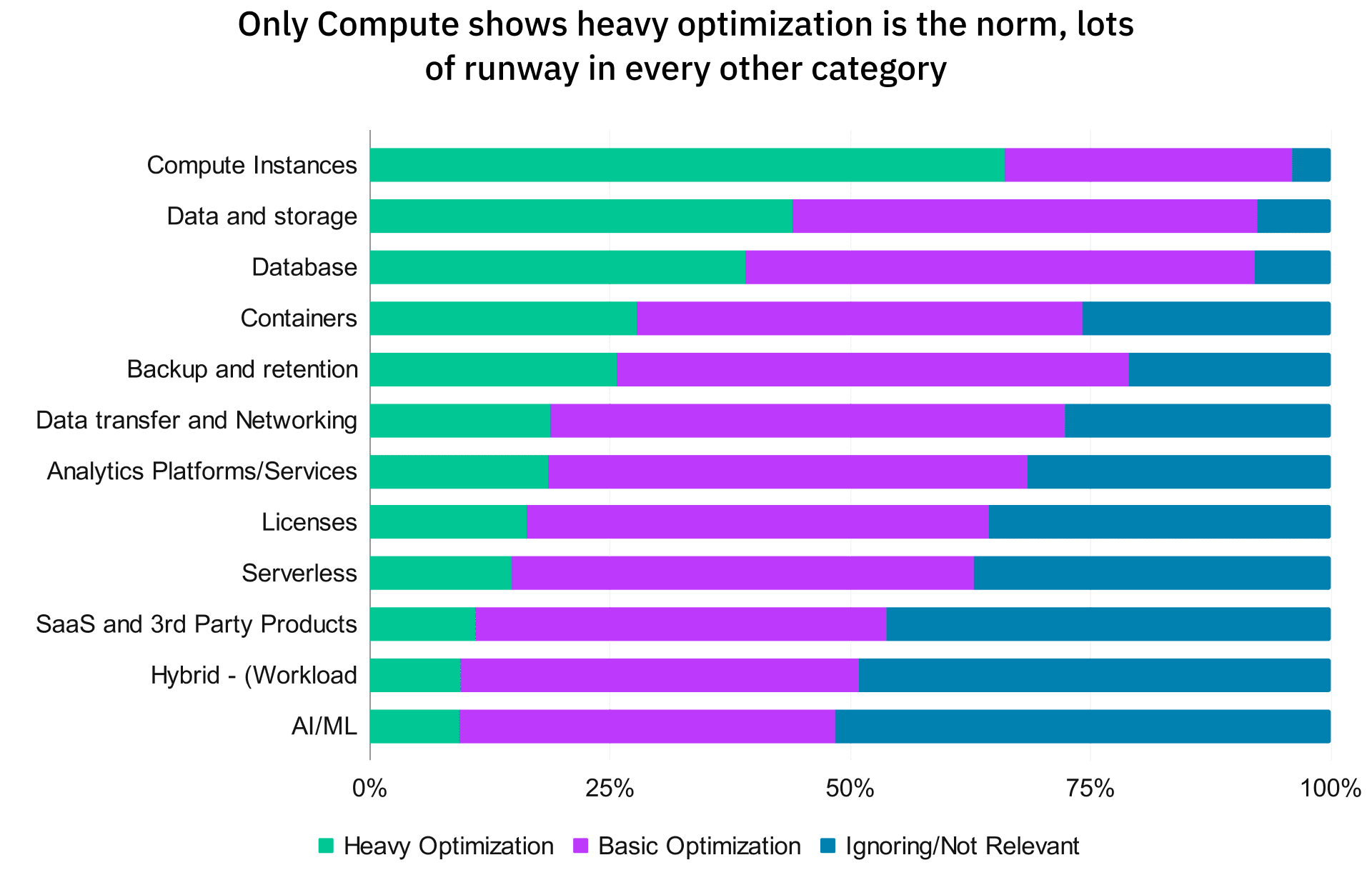

Compute (e.g., Amazon EC2, Google Compute Engine, Azure Virtual Machines, etc.) spending continues to be the most heavily optimized area of cloud spend. This is not surprising, as it is also the highest spend area for most. Cloud service providers also offer the richest set of discounts and optimization tools for compute, and many 3rd party providers offer compute optimization offerings to reduce waste.

Practitioners are starting to look into additional areas of spend beyond compute, with most having at least basic optimization for storage and database resources. However, there is still room for improvement, especially for costs associated with newer technologies like containers, serverless, AI/ML, etc.

⇒ In 2023 the FinOps community created a library of optimization opportunities to help you improve optimization on AWS, Google Cloud, and Microsoft Azure.

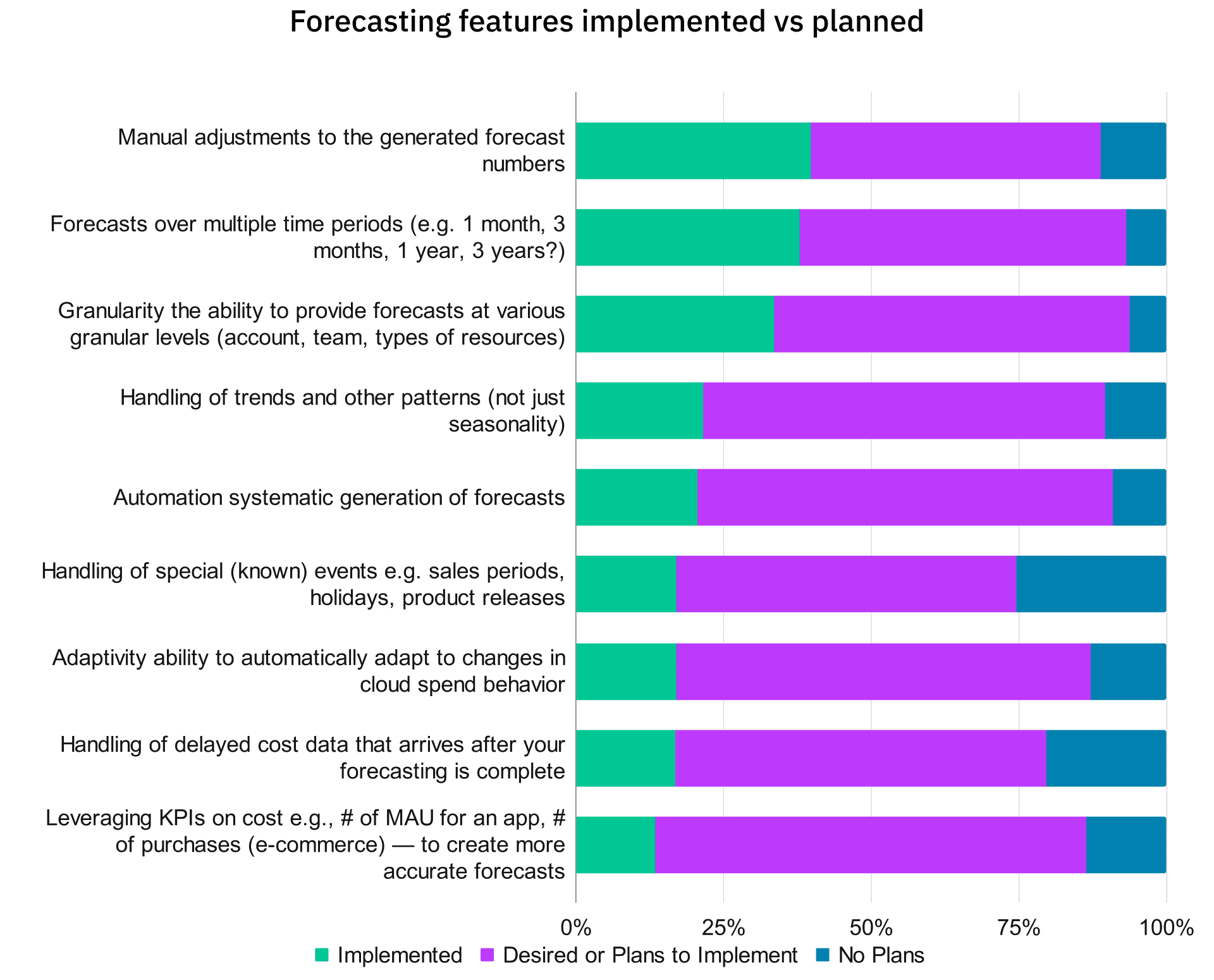

Forecasting is a critical component of FinOps. Organizations that are able to accurately predict their cloud spend are in a better position to take advantage of the myriad tools and resources offered by public cloud providers. This predictability gives leadership confidence to let engineers experiment and innovate, leading to better business outcomes.

This year’s survey included a list of forecasting capabilities and asked practitioners to indicate which they have already implemented, which they plan to implement, and which they have no plans for. The data show that considerable improvements are still needed. Practitioners report that many forecasting features are yet to be implemented, either due to lack of sophistication, tooling, or process.

The most commonly implemented forecasting feature was manual adjustments to the generated forecast numbers (which is also the easiest to implement), while the most desired features include leveraging KPIs on cost, better handling of delays of cost data, and automatic adjustments based on changes in behavior. Many have desires to improve forecasting capabilities in their practice or are actively planning to implement improvements to their forecast processes and tooling.

FinOps is most successful when people are empowered to take cloud costs into consideration as part of their role responsibilities. FinOps reports (whether native, 3rd-party, or home-grown) should convey the required information to any FinOps persona so they can answer their own questions without having to ask others. With more self-service ability to analyze data, decisions can be made quickly so the organization can be more agile.

This year’s research reveals that the core FinOps Personas are getting the most benefit from self-service reporting. Engineers are clearly leading the way in getting value from FinOps reports. FinOps practitioners should aim to deliver self-service reports that enable real-time decision making for all personas. Sustainability and procurement functions lag behind in getting value from self-service FinOps reports. Incomplete data may be a part of the challenge for sustainability teams, while additional cloud and FinOps education is needed for many procurement teams.

Figure 7: Engineers are getting the most value from self-service reporting.

We also asked respondents which functional teams have increased—or have planned to increase—FinOps training, and the results were similar to the question above. This is telling. The data suggest that the more a team is trained on FinOps, the more it gets value from self-service reporting. Over the last 3 years, the work that FinOps teams have done to empower engineers with data and training appears to be paying off.

Figure 8: FinOps training is increasing for all personas, but engineering has had the most investment.

Artificial Intelligence/Machine Learning was a hot topic in 2023. For FinOps practitioners, the use of AI/ML surfaces in two ways:

While many organizations set their engineers and data science teams free to bring AI/ML into their organization’s offerings, very few are yet doing FinOps on their AI/ML costs. Only 31% of survey respondents said that the costs of AI/ML are impacting their FinOps practice today. We see a big opportunity for FinOps practices and tools to ensure and demonstrate value from AI spending.

Figure 9: Most not yet experiencing the impact of AI/ML costs, but many are expecting it to start soon.

When we filter the data to large cloud spenders ($100M+ annually), AI currently impacting your FinOps practice rises from 31% to 45%, which aligns with the data we collected about increasing priorities. Organizations with a higher overall cloud spend tend to see AI/ML as a rapidly increasing source of variable cost that needs to be managed.

Figure 10: Impacts felt by AI/ML for large cloud spenders, almost half say AI/ML costs have rapidly increased.

This period for AI is reminiscent of when cloud itself first hit the scene. Large amounts of unbounded experimentation was encouraged early on with little consideration to cost or governance, until the costs began crossing budget thresholds or growing faster than expected. At that point, experimentation was slowed or stopped, and efforts were made to reduce costs. We recommend that for any new cloud technology that an organization wants to adopt, that reporting, forecasting, and basic basic guardrails be implemented early to ensure that experimentation is enabled within limits, and major rework is avoided.

It will be exciting to watch how the use of AI/ML unfolds over the next year. Will AI/ML become one of the biggest costs to manage across all levels of cloud spend, adding to the FinOps practitioner’s already full plate? Or will the technology be leveraged to make things easier for practitioners, unlocking more intelligent optimization and automation? The former is already happening for some, while the latter is still a hope.

The FinOps community has been showing more interest in sustainability over the past year, encouraged by initial sustainability data becoming available from cloud service providers (e.g., Google Cloud, AWS, Microsoft Azure), and by new government regulations for sustainability reporting.

Globally, less than 20% of FinOps teams are currently collaborating with sustainability teams (or taking on the responsibility of cloud sustainability themselves). However, half of respondents see collaboration with sustainability teams becoming part of their job in the future. Additionally, a shift is anticipated in the level of collaboration. Today, collaboration amounts to information sharing, but going forward, tighter collaboration with shared responsibilities is expected.

Figure 11: The intersection of sustainability with FinOps is low today, but a significant increase is expected in the future.

The EMEA region has led the charge of sustainability reporting, so it is not surprising that when splitting this data by region, EMEA reports that nearly twice the number of FinOps practices are actively collaborating with sustainability teams, and a larger number of FinOps practitioners expect it to become part of their role in the future (when compared to North America).

Figure 12: FinOps and sustainability teams collaborate more in EMEA than in North America, perhaps driven by local reporting requirements.

Low active collaboration indicates that best practices for integrating FinOps and sustainability are still nascent and not well defined. Differing means—and maturity— of reporting between the cloud providers further complicates the efforts. Unlike cost and usage data, which have nearly a decade of development (depending on the provider), sustainability reporting is still maturing.

⇒ The forthcoming 2024 revisions to the FinOps Framework will add Sustainability as a new Capability and Persona to support this evolution in collaboration. We expect to see rapid proliferation of sustainability data and development of best practices as FinOps teams work to add carbon emissions data to their decision-making frameworks.

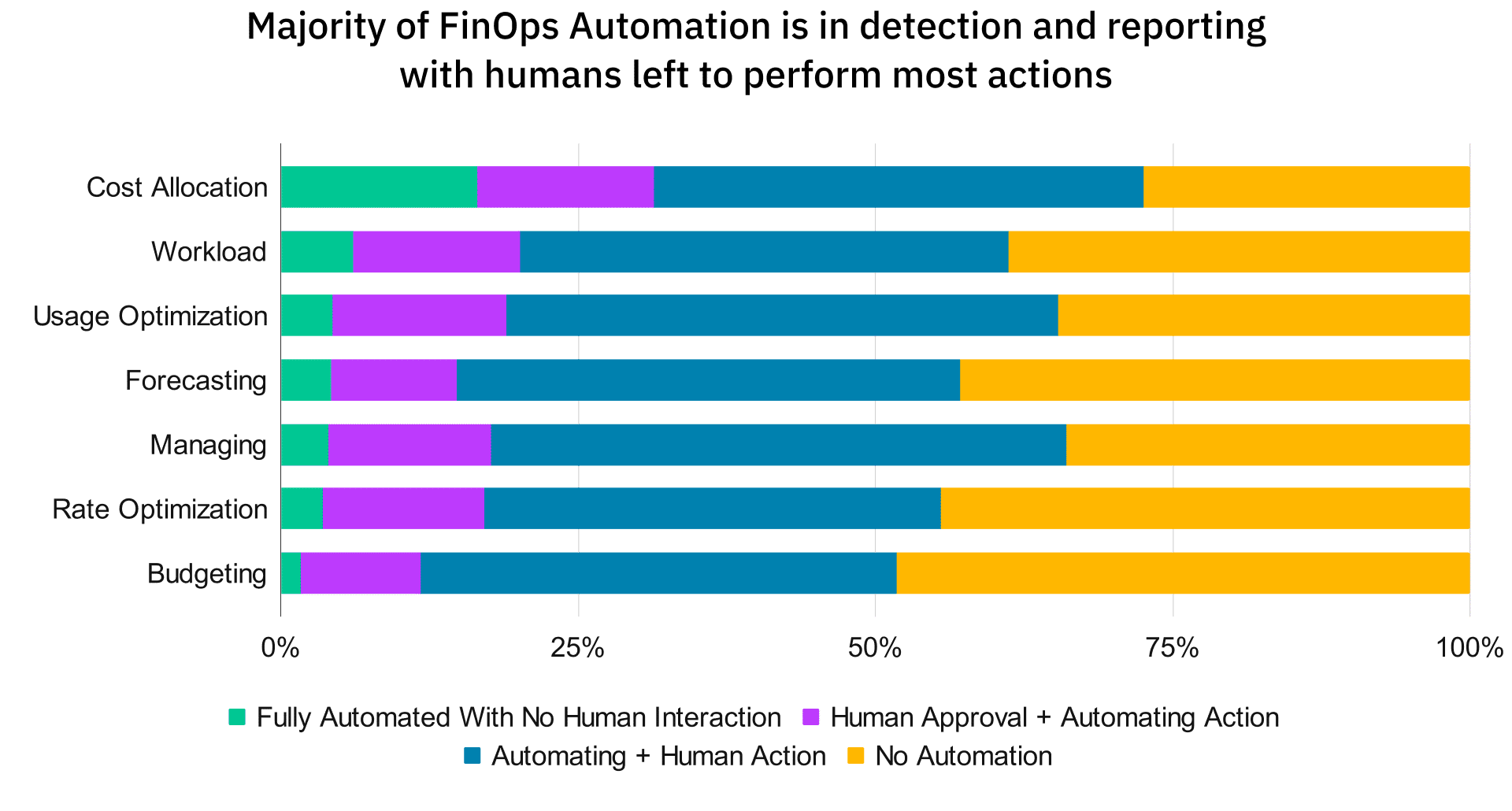

Automation was the highest increased secondary priority (not key priority), especially for those with small to medium cloud spend. Combined with the increased focus on optimization, it is clear FinOps teams are aiming to leverage automation to do more (optimization) with less (effort) to scale efficiently.

Figure 13: The biggest increase in priority is automation, signaling improving FinOps maturity, and also a desire to do more with less.

In order to understand what automation looks like inside FinOps teams, this year’s State of FinOps survey asked if humans are still taking part in the decision and action stages of automation. The data revealed that, for most, automation is used to gather data and detect the need for action, but humans are still taking the actions manually.

When we discuss automation with the FinOps community, we hear there is a lack of trust in full automation, where action is taken without any human approval. Anecdotally, we heard that large spenders, especially those in regulated industries, are more cautious about automation. We also hear that integrating automation into existing systems and workflows is challenging, especially in environments where DevOps teams are distributed and use a mix of tools in their cloud deployments.

These challenges, combined with the lack of trust in full automation (which could take years to build), suggest that FinOps teams—and tooling providers—will have more impact adding elements of human-vetted automation to existing practices than trying to fully automate a task.

Priorities for FinOps practitioners shifted in 2024 to align primarily with macroeconomic conditions, and secondarily with global shifts toward sustainability and the use of AI. The practice of FinOps sits at the juncture of finance and technology, so it’s easy to see how difficult macroeconomic conditions, and the introduction of new technologies, render this role more critical for businesses than ever before. Gaining organizational adoption and executive support of FinOps are key ingredients to their success.

As more organizations leverage AI for a variety of use cases, FinOps practitioners are evolving their practices to align the use of this technology with business objectives. They are also looking at how they can increase collaboration with sustainability teams, as FinOps practitioners expect it to become a larger part of their role.

This year’s data illustrate that FinOps is not a one-and-done cost-cutting activity. FinOps is about aligning spending to business goals, and since business goals must shift from time to time (as they did this year), FinOps is never done. Businesses continue to need FinOps practitioners to help shift behavior as cloud adoption hits material levels, and to maintain it when business priorities change.

There are many more data points from the State of FinOps survey and we will continue to provide our perspectives on these core topics. We encourage you to check out the full results at data.finops.org and watch the replay of the February Summit. We thank everyone who contributed to this year’s survey and look forward to hearing how your practices develop over the next year.